Frequently Asked Questions

Why are you opposing the legislature's corporate and personal income tax increases?

Why are you opposing the legislature's corporate and personal income tax increases?

A. In the midst of the worst economic crisis in more than 70 years, the legislature voted to permanently increase income taxes on businesses and high-income Oregonians by $733 million - the biggest tax increase in Oregon history. Legislators say it's only a tax on the rich. They're right. We'll end up paying more for our country club memberships, gas for our Hummers and other "services," like those quarterly junkets to Vegas. And that will impact all Oregonians, especially the poor. Businesses would be forced to decide between laying off workers, or reducing CEO compensation. The choice is clear. The CEO is the boss.

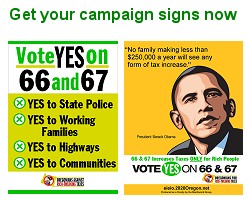

Who opposes the permanent tax increases?A. Oregonians Against Job-Killing Taxes (OAJKT), a leash-led coalition of the state's wealthiest business groups and individuals, is running the campaign to defeat both tax increases at a special election on January 26, 2010.

Who's behind the permanent tax increases?A. Labor Unions, Liberals, Communists, and Socialists.

What does the proposed permanent tax increase on businesses involve?A. The most damaging increase in HB 3405, the business tax increase plan, is the way legislators chose to address Oregon's outdated corporate minimum tax, the amount corporations pay when they have no profits to tax. Small businesses with annual sales less than $500,00 will pay an outragous $150 in new taxes. LLP's, S Corps, LLC's and partnerships will pay a hideous $150 regardless of income or profits. To save us $150 dollars a year, we urge you to vote no. If these taxes pass, we'll have to spend tens of thousands of dollars to relocate to another state with higher corporate taxes to avoid Oregon's new tax, and fire a bunch of workers in the process.

What does the proposed permanent personal income tax increase involve?A. Individuals earning more than $125,00 or couples earning more than $250,00 (after business expenses, payroll etc are deducted) will be affected by the new income tax rate. As a result, these rich folks will be forced to fire the cabana boy and the downstairs maid. Maybe even have to shave a day off of that up-coming cruise trip.

If businesses have money to fund a campaign, how come they can't afford the new taxes?A. You see, that's the thing. We corporations always love to throw our bucks around. Sure, we'll spend enough on this campaign to house and feed a small town. But we'd much rather piss and moan about how much extra money we have to pay the state, and then threaten the voters to scare them into not passing taxes that have no effect whatsoever on themselves.

Why would permanently increasing taxes affect jobs?A. Quite simple, actually: When an expense is encountered, we multiply that cost by ten, and then pass it on to the consumer. So do the math! $150 times ten equals $1,500. About the monthly wages of one of our seasonal workers. So an extra $150 in annual taxes really means $1,500 dollars that we have to get back from consumers. Easiest way is to fire a bunch of low-paid workers.

Didn't the legislature have to raise taxes in order to balance the state budget?A. Not really. The legislature is back to business as usual, trying to institute fair and equitable taxes. If these taxes pass, Oregon lawmakers will continue to spend and spend and spend, just like we Republicans do. Only we have the common courtesy to not increase taxes when WE increase spending.

Will education, public safety and services for the poor suffer if the taxes do not pass?A. That's up to the legislature. We frankly don't give a rat's ass. All our kids go to private schools, and our gated communities have their own security.

How were legislators able to pass such big permanent tax increases?A. It was those damn socialist Unions. And the tree-hugging, mocha-slurping, incense burning, yoga-bending, sprout-eating, elbow-sneezing liberals.

Is it true that business just wants to protect the extraordinarily low $10 corporate minimum tax? Is that why you're opposing these taxes?A. Absolutely! Wouldn't you? The cost was set at $10 in the 1930s. Inflation alone drops that amount down to around two bits. An appropriate amount for a two-bit dump like this place!

Aren't these taxes just restoring fairness to Oregon's tax system and asking those who can afford to pay more to contribute their fair share?A. Fair? Certainly not fair to us! We deserve a free ride! No taxes whatsoever! Rich people that "can" pay more shouldn't have to pay anything! We drive the economy, so it's only logical that we should get a free ride! Besides, we offered a tax increase ourselves once...

Are you saying the business community proposed some tax increases?A. You bet! But the liberal socialists turned us down flat. Bastards. Now we'll have to fire a bunch of low wage employees to help pay for the next full-page newspaper ad against these hideous tax increases! See what they are making us do? It's un-American!

The Oregon Center for Public Policy says that in 2006, 31 companies with Oregon profits of more than $1 million paid no Oregon corporate income taxes beyond the $10 minimum. And more than 5,000 other profitable companies got away paying just $10 in taxes. Is that true?A. Yes, and there are good reasons why. Unlike the average household of working families, we can write off pretty much all of our expenses. Even the bloated salaries of our CEOs! This way we can insure that we show an annual lose "on paper" as to avoid paying higher evil taxes. Besides, OCPP is a hot-bed of Socialist radicals and BlueBloggers.

Why should companies get such tax breaks and loopholes? I have to pay my taxes.A. Because we are better than you, the average consumer. We drive the economy! Without our hard-earned profits, there would be nothing for you to consume, you ungrateful morons! And besides, we really don't care about you. We just want you to vote against these taxes so that our bottom line remains strong(er).

Oregon businesses aren't paying their fair share. The corporate share of Oregon taxes has been declining over time.A. HEY!! You're not paying attention! We really don't care! We feel that the burden of running society should be squarly on the backs of it's middle and lower classes. Not on the corporate business community. PERIOD.

High-income Oregonians aren't paying their fair share. Isn't it fair that, when times are tough, like now, to ask a little more of those who are doing better than the rest of us?A. Hell no! Of course not! We shouldn't have to pay anything! And if that damn accountant was more on the ball, we wouldn't have to!

What about state government's needs? If the legislature's tax plan doesn't pass, schools and state programs will be short $733 million. How will that gap be filled?A. It's not about what state government needs. It's about what Oregon corporations need. Who needs the State Police? A private security firm like Blackwater would be more cost effective anyway. And we could simply solve the school issue by having vouchers and more private schools.

With all your big money, how come you have such poorly designed campaign materials?A. It gives the illusion that this is a grass-roots operation, being run by many "Moms and Pops" with their own software sitting around kitchen tables with their aging laptops. If we used the same firm that does our corporate Website, then folks might think that we have better stuff to spend money on, like taxes.